Contents

Rather, currency trading is conducted electronicallyover the counter , which means that all transactions occur via computer networks among traders around the world, rather than on one centralized exchange. This means that when the U.S. trading day ends, the forex market begins anew in Tokyo and Hong Kong. As such, how to measure pips the forex market can be extremely active anytime, with price quotes changing constantly. The average daily trading volume of the forex market now exceeds 5 trillion U.S. Liquidity refers to how easy it is for market participants to open and close positions without affecting the price of the underlying asset.

You would sell the pair if you think the base currency will depreciate relative to the quote currency. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. Learn how to trade forex in a fun and easy-to-understand format.

Other economists, such as Joseph Stiglitz, consider this argument to be based more on politics and a free market philosophy than on economics. Luckily, you don’t need to have a degree in finance to master it! FBS broker has an exceptional section of educational and analytical materials explaining how to act when prices go up or down in simple terms. Anyone can trade on Forex, but it is only accessible through mediators called brokers.

In this page, we’ll cover how you can find out what makes it so popular first hand. Like with any type of trading, financial market trading involves buying and selling an asset in order to make a profit. In order to make a profit in foreign exchange trading, you’ll want the market price to rise above the bid price if you are long, or fall below the ask price if you are short.

Overtrading. Overtrading – either trading too big or too often – is the most common reason why Forex traders fail. Overtrading might be caused by unrealistically high profit goals, market addiction, or insufficient capitalisation.

On the other hand, most institutional forex activity is geared towards hedging against currency and interest rate risk or to diversify large portfolios. Profit is not a guarantee while trading in the foreign exchange market. Most people lose more than they make while trading currency pairs.

Built from feedback from traders like you, thinkorswim web is the perfect place to trade forex. Its streamlined interface places tools most essential to trades at center-stage and allows you to access your account anywhere with an internet connection. Execute your forex trading strategy using the advanced thinkorswim trading platform. Gregory Millman reports on an opposing view, comparing speculators to “vigilantes” who simply help “enforce” international agreements and anticipate the effects of basic economic “laws” in order to profit. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse.

Additionally, a trading plan that performed like a champ in backtesting results or practice trading could, in reality, fail miserably when applied to a live market. By starting small, a trader can evaluate their trading plan and emotions, and gain more practice in executing precise order entries—without risking the entire trading account in the process. Once a trader has done their homework, spent time with a practice account, and has a trading plan in place, it may be time to go live—that is, start trading with real money at stake. No amount of practice trading can exactly simulate real trading. Nearly all trading platforms come with a practice account, sometimes called a simulated account or demo account, which allow traders to place hypothetical trades without a funded account. Perhaps the most important benefit of a practice account is that it allows a trader to become adept at order-entry techniques.

You can read more and download the trading platforms from our trading platforms page. Forex trading platforms have transformed how people interact with financial markets. They enable investors to easily access hundreds of different markets across the globe. Forex traders who use technical analysis study price action and trends on the price charts. These movements can help the trader to identify clues about levels of supply and demand. Cross currency pairs, known as crosses, do not include the US Dollar.

In the forex market, a trader can hold a position for as long as a few minutes to a few years. Depending on the goal, a trader can take a position based on the fundamental economic trends in one country versus another.

For example, the Dutch Auction System of FX bidding provides a window through which the participating banks could boost their liquidity position on regular, largely, weekly basis. One way through which this is achieved is when, on weekly basis, huge float domestic currency funds accumulate in the customers’ current accounts as deposits for the FX bidding. The banks would retain and continue to utilize the funds until and pending when the amounts equivalent to the customers’ bid have been debited from their accounts with the Central bank. Like any other investment arena, the forex market has its own unique characteristics. In order to trade it profitably, a trader must learn these characteristics through time, practice, and study. His simple market analysis requires nothing more than an ordinary candlestick chart.

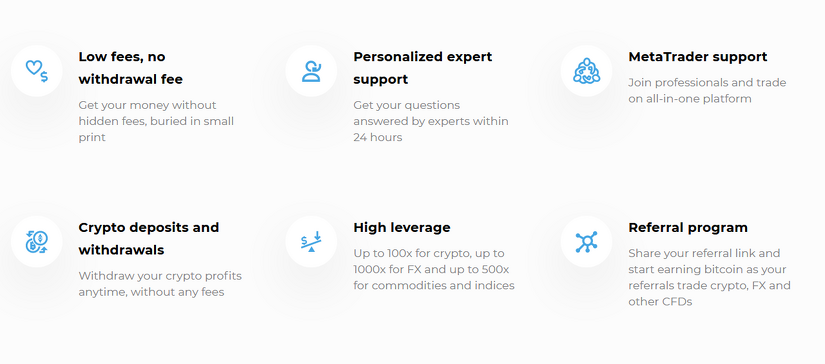

The forex market provides ample opportunities for traders, allowing them significant access to leverage, the ability to trade 24/7, and the possibility of getting started with a small capital outlay. There are plenty of online brokers they can use, providing them with a wealth of options. Forex trading is often hailed as the last great investing frontier – the one market where a small investor with just a little bit of trading capital can realistically hope to trade their way to a fortune. Risks related to interest rates – countries’ interest rate policy has a major effect on their exchange rates. When a country raises or lowers interest rates, its currency will usually rise or fall as a result.

The currency market is a dealer market made largely by the same dealers active in the bond market. Currency dealers display indicative quotes, but quotes at which trades may occur are usually made bilaterally. Like the bond market, the currency market has an interdealer market in which dealers can trade anonymously with each other. The significance of competitive quotes is indicated by the fact that treasurers often contact more than one bank to get several quotes before placing a deal. Another implication is that the market will be dominated by the big banks, because only the giants have the global activity to allow competitive quotes on a large number of currencies. Retail traders can face substantial risks because of easy access to leverage and lack of understanding of how it all works.

Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organisations. So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night – resulting in a gap. If you’re day trading a currency pair such as the USD/CAD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot .

During the 1920s, the Kleinwort family were known as the leaders of the foreign exchange market, while Japheth, Montagu & Co. and Seligman still warrant recognition as significant FX traders. The trade in London began to resemble its modern manifestation.

They are regulated by FEDAI and any transaction in foreign Exchange is governed by the Foreign Exchange Management Act, 1999 . National central banks play an important role in the foreign exchange markets. They try to control the money supply, inflation, and/or interest rates and often have official or unofficial target rates for their currencies.

In a position trade, the trader holds the currency for a long period of time, lasting for as long as months or even years. This type of trade requires more fundamental analysis skills because it provides a reasoned basis for the trade. In its most basic sense, the forex market has been around for centuries. People have always exchanged or bartered goods and currencies to purchase goods and services. However, the forex market, as we understand it today, is a relatively modern invention. If you are living in the United States and want to buy cheese from France, then either you or the company from which you buy the cheese has to pay the French for the cheese in euros .

If you want to open a long position, you trade at the buy price, which is slightly above the market price. If you want to open a short position, you trade at the sell price – slightly below the market price. In the U.S., forex brokers provide leverage up to 50 to 1 on major currency pairs. A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair.

The foreign exchange market works through financial institutions and operates on several levels. Behind the scenes, banks turn to a smaller number of financial firms known as “dealers”, who are involved in large quantities of foreign exchange trading. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the “interbank market” .

Assume that the trader is correct and interest rates rise, which decreases the AUD/USD exchange rate to 0.50. If the investor had shorted the AUD and went long on the USD, then they would have profited umarkets from the change in value. Hedging of this kind can be done in the currencyfutures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority.

The aim of technical analysis is to interpret patterns seen in charts that will help you find the right time and price level to both enter and exit the market. A forex trader will tend to use one or a combination of these to determine their trading style which fits their personality. Compared to crosses and majors, exotics are traditionally riskier to trade because they are more volatile and less liquid.

Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions. Let’s imagine it rose from 1.25 to 1.35 – it is a profitable situation for you, so you can close the trade at this point. Now, you can exchange your 80 euros back to 108 dollars, and get your profit of $8.

You’ve probably heard of stories where a trader took a small account and trade it into millions within a short while. Clearly, your risk to reward and win rate are meaningless on its own. “This is how Bob down the street from you got his start. I know it’s a lot of money, but I’m in—and so is half our club. It’s swissquote forex review worth every dime.” Head over to the City Index Academy for curated courses designed to get you started on the markets. Standard stop losses and limit orders are free to place and can be implemented in the dealing ticket when you first place your trade, and you can also attach orders to existing open positions.

In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows. These are caused by changes in gross domestic product growth, inflation , interest rates , budget and trade deficits or surpluses, large cross-border M&A deals and other macroeconomic conditions.

Trade your opinion of the world’s largest markets with low spreads and enhanced execution. Forex trading is available 23 hours per day Sunday through Friday. Was spot transactions and $4.6 trillion was traded in outright forwards, swaps, and other derivatives. Prior to the First World War, there was a much more limited control of international trade. Motivated by the onset of war, countries abandoned the gold standard monetary system.

FXCM is a leading provider of online foreign exchange trading, CFD trading and related services. Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders. Large hedge funds and other well capitalized “position traders” are the main professional speculators. According to some economists, individual traders could act as “noise traders” and have a more destabilizing role than larger and better informed actors.

Accordingly, the values of several key Forex pairs could be set for a shift. Use our trading tools such as Stop Loss, Stop Limit and Guaranteed Stop to limit losses and lock in profits. Get FREE real-time forex quotes and set indicators to easily analyse charts. Even Reddit has countless pages in which not only forex traders but also stock, options, futures, and other traders, share their ideas. Considering that on average 95% of forex traders fail, trading isn’t an easy skill to acquire. If you lose more money than your initial deposit, your account could go negative and your broker may ask you to repay it.

Your FOREX.com account gives you access to our full suite of downloadable, web, and mobile apps. Build your confidence and knowledge with a wealth of educational tools and online resources. Take control of your trading with powerful trading platforms and resources designed to give you an edge. The difference between the bid and the ask price is known as the SPREAD. More specifically, that the currency you bought will increase in value compared to the one you sold. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost.

For example, in the EUR/USD pair the value of one Euro is determined in comparison to the US dollar , and in the GBP/JPY pair the value of one British pound sterling is quoted against the Japanese yen . Trade the most popular forex pairs like EUR/USD, GBP/USD and EUR/GBP at Plus500. Use our advanced trading tools to protect your profits and limit losses. Consider opening a Forex account with Statrys, and in under 72 hours you’ll be able to make trades in 11 currencies at competitive prices. If a beginner forex trader gives up because of too many losses early on, then this contributes to the “95% of forex traders fail” psyche.